Building a customer-first FSP brand from the ground up

The Work

How digital alignment delivered over 500M in business value over 3 years

How digital alignment delivered over 500M in business value over 3 years

When we first took up the brand in 2019, NCBA Bank (formerly NIC & CBA) had just announced the merger, landing it a spot as the ‘new kid on the block’ in the Kenyan Banking scene. With this came 2 key challenges:

After the name of the new bank was announced quicker than planned, our initial teaser and launch strategy was immediately altered and we developed a plan to get everyone clear on the new name & values by utilising digital to inform our existing customers, release information to the press, live stream the press launch and the NSE re-listing.

Due to the increased competition in the banking industry, we developed a strategy to increase brand love and connection with our audience through the creation of non – product customer content.

While marketing bank products, we made banking products cool and relatable through showcasing value and connecting the needs of our audience to our products.

Making the community a better place is central to the NCBA philosophy. Using our video production skills, we created video content that adequately reflected the strides by NCBA in impacting lives while telling stories

For Youth and Education Enterprise we curated videos that showcased the bank’s commitment to making a positive impact in society. Through leveraging the digital space, we created favourability among stakeholders.

A spin off to the regular content that the brand creates, this program involves the use of micro influencers on social media to create a buzz around a product or campaign that we are launching.

Research shows that:

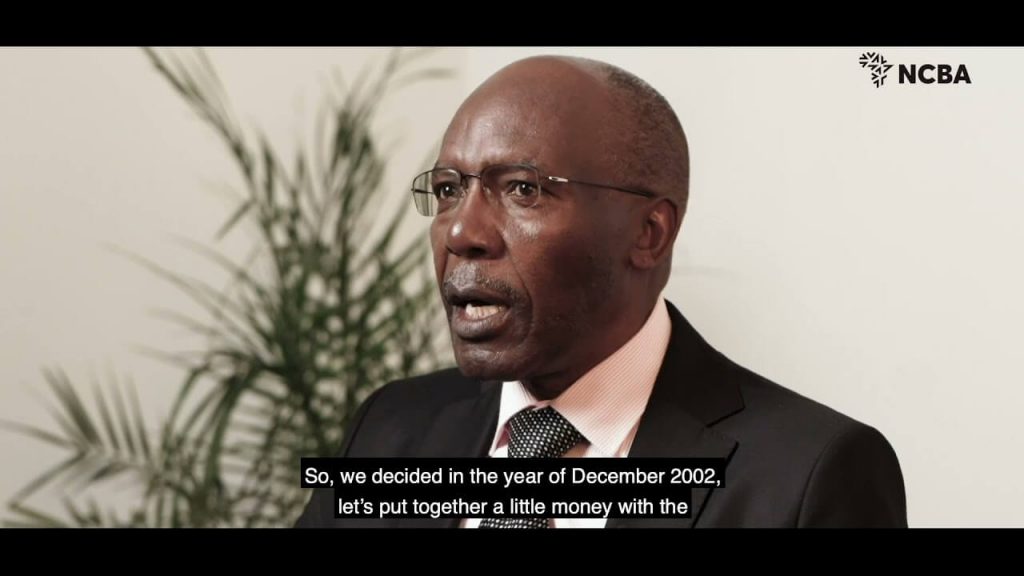

In order to build trust with our audiences, we therefore took on a relationship marketing approach by leveraging on customer testimonials which allowed our customers to speak to the bank’s strong suits on their behalf.

By lending the brand a space as a thought leader in the Kenyan banking industry, we leveraged on the use of content marketing to further entrench NCBA as a credible bank that can be trusted. We did this through:

An online video series on everything money matters where we teach you how to

make your money work for you.

Through the bank’s citizenship pillar ‘Environment and Natural resources’, we participate in an initiative called ‘Change the Story’ where we build the communities around us with a focus to ensure that we live behind our world better than we found it.

Money Mastery has enabled the bank to be a leader in financial literacy in Kenya while ensuring it remains credible to our audiences.

Through profiling the bank’s Group Managing Director, we have been able to ensure that he is well visible to our audiences allowing him to remain as the trusted captain of NCBA.

Creation of a strong “leads machine” – 1.2K/week leads on avg.

Each week, we track the collected leads both on social media and our website where we have averaged a total of 1,200 leads a week. These are then shared with the customer experience team of the bank who we partner with to ensure that all leads are closed.